Classic option – what is it?

The concept of “classical” can be applied to both vanilla and binary options. From the very beginning of their history, they began to gradually change and transform, with more and more new types being created. By the way, even binary options are one of the subtypes of regular options, and before they began to exist in the form familiar to us, they went through more than one stage of the “evolution” of securities. The classical option gradually becomes the prototype of new types, and they, forming certain standards and new types, also gradually become classical, but already within their own subtype.

What is a classical vanilla option?

An agreement between two parties, one of which receives the right, but not the obligation, to buy or, conversely, sell a certain asset at a fixed price agreed upon at the present moment in the future, is called a standard or “vanilla” (plain vanilla option).

An agreement between two parties, one of which receives the right, but not the obligation, to buy or, conversely, sell a certain asset at a fixed price agreed upon at the present moment in the future, is called a standard or “vanilla” (plain vanilla option).

Such a tasty name was given to the document because of its simplicity and accessibility. Financiers drew an analogy with vanilla ice cream, which is always the cheapest, but no less tasty.

The emergence of classical vanilla options

For the first time, this type of security appeared in Europe, more precisely in Holland during tulip mania — a period in the history of this country when demand for tulips grew so much that the price of this flower rose to unprecedented levels. Such huge demand gave rise to many people wanting to make money, but few had the funds to open their own flower shop. Traders issued securities according to which they were obliged to sell tulips at a price much more favorable than the market price, and in return asked for a premium. With the funds received, a shop was opened, buyers received their flowers at a low price, and the seller received good profit and advertising.

Soon this type of security was recognized by one of the largest and oldest stock exchanges in the world — the London Stock Exchange. It began to provide conditions for the purchase and sale of this security, as well as to control the correctness of all transactions.

The modern history of vanilla contracts began in the 1970s, when the first options market was opened — the Chicago Board Options Exchange, where today more than half of all such transactions in the world take place.

The underlying asset of a classical vanilla option

The underlying asset is the main object of the transaction. It is precisely what the holders of the contract wish to buy or, conversely, sell. Depending on which asset acts as the underlying one, any options can be divided into exchange-traded, commodity, and currency.

Exchange-traded options are the largest and at the same time the most confusing type of contract. This term simultaneously refers both to transactions whose underlying asset is other types of securities, and to transactions whose correct execution is controlled by a global financial exchange; that is, in some sense, both commodity and currency securities can be called exchange-traded. A document concluded between two parties without the participation of an intermediary in the form of exchanges is called over-the-counter.

It is worth taking a closer look at exchange transactions as a type of contract that gives the right to buy or sell securities. Most often, shares of various companies act in this capacity. Exchange contracts are acquired in order to make a profit from fluctuations in the market value of an asset without taking on large financial risks.

Commodity options are precisely the types of securities that were first issued in Holland, since their main object was flowers, that is, a commodity. In the concept of financial markets, commodities include items that are the product of large industry or small production. On exchanges, commodity contracts mainly circulate for minerals, precious metals, stones, ore, and crops.

Commodity options are precisely the types of securities that were first issued in Holland, since their main object was flowers, that is, a commodity. In the concept of financial markets, commodities include items that are the product of large industry or small production. On exchanges, commodity contracts mainly circulate for minerals, precious metals, stones, ore, and crops.

Currency or, as they are also called, Forex or FX options give their buyer the right to exchange a certain currency at the price valid at the current moment in the future. They can be used by traders, that is, players in financial markets who participate in trading on their own behalf and wish to make a profit precisely from the trading process itself. Such participants realize securities at moments of currency decline or growth. With the help of contracts, traders can make a good profit, while they do not even have to acquire the asset itself.

In addition, currency transactions are popular among exporters/importers, who thus insure themselves against financial losses in the event of a sharp change in the exchange rate.

Recently, settlement contracts have become very popular. They do not imply the transfer of an asset from hand to hand. The seller compensates the buyer’s profit based on the difference between the strike and the market price.

Strike price of a classical vanilla option

The strike is the price of the underlying asset that is specified in the document. It can never change under any conditions and remains inviolable throughout the entire term of the document. As a rule, it is determined according to the state of the asset on the market at the time the contract is concluded, or for this purpose an average statistical number is calculated over a certain period.

Premium of a classical vanilla option

As is known, the holder of a security receives only a right, but is not obliged to do anything, while for the seller everything is the opposite. The existence of such an unequal transaction is simply impossible without the presence of an additional balancing factor. In this capacity, the premium acts — the amount of money paid by the buyer of the document.

As is known, the holder of a security receives only a right, but is not obliged to do anything, while for the seller everything is the opposite. The existence of such an unequal transaction is simply impossible without the presence of an additional balancing factor. In this capacity, the premium acts — the amount of money paid by the buyer of the document.

The premium is also called the option price. It is always equivalent to the risk imposed on the seller. For example, the premium increases if the strike price does not correspond to the market price or if a long term of the transaction is set.

Expiration period of a classical vanilla option

The expiration period is the validity period of the document during which the buyer’s right and the seller’s obligation are preserved. Depending on the duration of this time, transactions can be divided into long-term and short-term.

Long-term options are contracts with a term of one week or more. Since prices change constantly and anything can happen over a long period, the seller’s risks increase sharply, and along with them the premium.

Short-term options are valid for no more than one day. The premium for such a contract is quite democratic, but predicting the exact behavior of the asset price in such a short period of time is much more difficult for a trader.

In some types of options, for example American ones, early expiration is possible, that is, the exercise of the rights given by the contract. Often, the concept of a classical option implies precisely the American one, since at the moment this transaction model is used almost always and everywhere, especially when trading on the exchange. Still, it cannot be said that the European option has already been forgotten. It is more popular outside financial markets and exchanges, between individual companies that cooperate without intermediaries.

Types of classical vanilla options

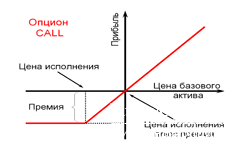

The main types are call and put contracts.

Call option gives the right to buy an asset. It is mainly used to make a profit by buying an asset in the future at a lower price agreed upon at the time of concluding the transaction and then reselling it at the market price. Calls are acquired at the moment when a jump in the value of the asset is expected in the near future.

Put option gives the right to sell an asset. It turns out that the buyer of the security acts as the seller of the asset, and the seller acts as its buyer. Such contracts are used to hedge investments in currency or shares. If a trader is not confident in their payback, he simply acquires such a contract and, in case of an unsuccessful outcome, sells the asset and gets the invested funds back.

Exotic types of binary options

Any object acquires the right to be called classical only when new directions appear that gradually take away its popularity but cannot completely replace it. For example, it never occurred to Beethoven and Chopin to call their music classical. It became such only after dozens and hundreds of new directions were created.

The same can be said about options. Their types, which differ noticeably from the usual model but still remain options, are called exotic. The main types of exotic transactions are barrier and range.

Barrier options differ from classical ones in that a barrier in the form of a certain condition is placed on the path of their execution. Most often this is the achievement by the market price of the asset of a certain value. For example, it is possible to buy an asset at a price of 50 rubles only if the market price reaches 60 rubles.

Range option adds another condition. For example, the asset must be more expensive than one amount, but not more than another.

Another type of exotic contract is the binary one. Soon it gained such popularity that it began to exist as a separate financial instrument.

What is a classical binary option?

A binary option is such an option that, depending on the fulfillment of the condition, can bring profit to its owner or give nothing. The condition for the execution of the contract is an increase or decrease in the market price of the underlying asset. At the same time, the asset itself is not acquired by either party: only its price is taken into account.

The particle “bi” translated from Latin means “two,” and “binary” means dual. This name was given for two reasons. First, two outcomes of the option are possible: its buyer receives either everything or nothing. The same applies to the seller (broker). That is why such options are often called “all or nothing.” Second, the trader can make only two types of bets — on price growth or on its decline.

The emergence of classical binary options

As has already been said, classical binary transactions originated from ordinary vanilla ones. For someone who is learning for the first time what classical and binary options are, it will be difficult to believe that they have a common origin. Binary securities did not appear immediately; gradually, more and more new conditions and rules were added to the familiar contract model, transactions consistently changed, and ultimately went a long way from one subtype to another.

The first step toward binary documents was barrier ones. They were no longer a type of security, but rather resembled betting activity. After all, in essence, the trader makes bets on whether the asset price will increase or, conversely, decrease. With the correct forecast, he receives this very asset at a price that is often much lower than the market price.

In both vanilla and binary options, the asset itself gradually began to leave everyday use. When trading on the exchange, neither the seller nor the trader is at all interested in the prospect of receiving or selling the asset; each of them hopes to subsequently sell it profitably and make a profit from the price difference. Roughly speaking, buy cheaper, sell more expensive. The removal of the underlying object from circulation is convenient for both parties: they save their time and immediately get exactly what they want. Such transactions began to be called settlement transactions.

These two steps turned ordinary securities into binary options. In 2008, the London Stock Exchange and the Chicago Board Options Exchange officially began trading these securities. Brokers (intermediaries) of the exchanges realized that the easy accessibility of this kind of securities makes it possible to promote them to the masses, among people who do not even think about trading on the exchange and investments. In the 2010s, an endless number of internet brokers began to appear, allowing trading in such types of securities without even leaving one’s favorite chair.

The underlying asset of classical binary options

If in vanilla securities the underlying asset is the main subject of trading, then in binary ones it is just a means of making a profit.

If in vanilla securities the underlying asset is the main subject of trading, then in binary ones it is just a means of making a profit.

It is precisely the absence of the underlying asset as such that made binary trading publicly accessible. A broker can conclude an endless number of transactions, the object of which will be the same asset.

In order to become a broker, it is not necessary to have large sums for investment. In addition, it is not necessary to thoroughly analyze the financial market, since when placing a bet there is no need to indicate the exact range of price increase; it is enough to make a bet on the direction in which it will move in the near future.

Strike price of a classical binary option

In vanilla options, the strike price can be determined in several different ways; in binary trading, only one method is available — setting the price that is valid at the moment the transaction is concluded. Moreover, not a separate day or hour is taken into account, but an exact indication of minutes and seconds.

The strike price is the threshold by which it is determined whether the asset has won or not.

Premium of a classical binary option

In binary trading, there are two concepts of premium.

The first type of premium differs little from the price of a standard option — it is the same amount of funds that the broker receives. Only in this case, the size of the premium is chosen not by the broker, but by the trader. It would seem to be a rather incorrect approach, because the buyer can indicate a price that is unfavorable for the seller. In fact, any price is equally profitable and unprofitable for both the buyer and the seller, since the amount of the buyer’s profit is fixed as a percentage of the size of his investment. The higher the price he offers, the more profit he can get. At the same time, his risk also increases, since in case of an unsuccessful outcome the money will not be returned.

Also, in binary trading, the profit that the trader receives in the event of a successful outcome of the transaction is called a premium.

Expiration period of a classical binary option

Such transactions are not concluded for long periods; as a rule, they do not last more than a minute.

The possibility of quick profit has become another reason for the popularity of trading in binary options.

Types of classical binary options

In binary transactions, there are also the concepts of “call” and “put,” but in this case these are only bets on one or another price direction in the near future.

A trader places a “call” if he is sure that within the specified period the price will rise, and a “put” if it will fall.

It turns out that in binary options, “call” and “put” are not two different types of securities, but only bets on one outcome or another.